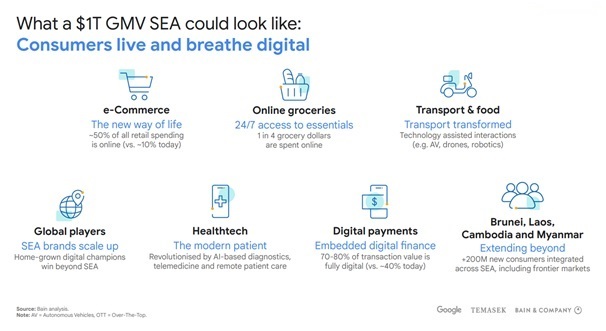

With nearly half a billion internet users, a majority of whom shop online, Southeast Asia (SEA) has a flourishing digital economy that is projected to reach US$1 trillion in Gross Merchandise Value (GMV) by 2030. And it’s not hard to see why.

Known for their cultural, political and economic diversity, the region’s major economies nonetheless share a few key traits, which are accelerating digital adoption: a young, digital-native population; an e-economy offering everything from groceries to food and financial services to serve a largely mobile-first customer base; and crucially, governments and regulators committed to building the infrastructure needed to sustain future growth in the space.

Source: Google, Temasek and Bain, e-Conomy SEA 2021

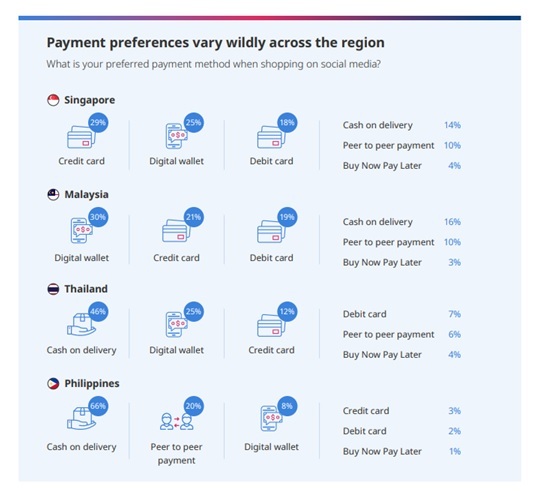

As the region’s population spends more time using online services, digital payments are predicted to dominate ecommerce transactions by 2025 with the Philippines, Thailand and Vietnam seeing the most significant shift from cash to digital payments.

While Southeast Asia’s move away from cash is a reflection of worldwide trends, the region’s digital landscape is being shaped by a unique set of factors, which are together creating an ecosystem capable of powering robust growth in digital payments in coming years.

Super-apps and social commerce take off

As consumers across the region embrace shopping, ordering food and cab rides from their mobile apps, the companies offering these services are taking notice. And they are responding by expanding their platforms to offer everything a consumer could conceivably need in their daily lives under a single umbrella, or a super-app as they have come to be known.

In a testament to this strategy’s success at attracting and retaining users, super-apps such as Grab (Singapore), GoJek (Indonesia) and Zalo (Vietnam) have become household names in Asia, alongside China behemoths such as Tencent’s WeChat and Alibaba’s AliPay.

Further, the region’s growing embrace of all things online is spilling over into social media channels and fuelling the growth of social commerce, where businesses and consumers take their cue from a growing cohort of influencers to sell and buy items directly on platforms like Facebook, Instagram, Line and YouTube.

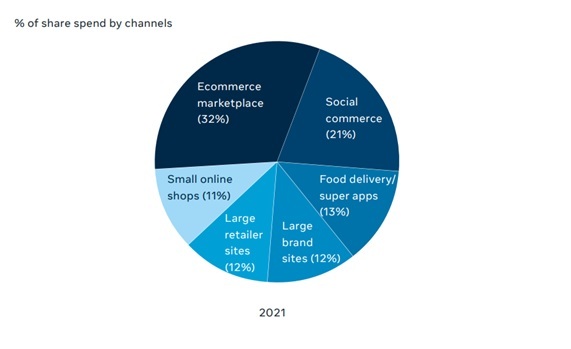

In 2021, research shows, social media was the second most popular avenue for online retail. The number of orders and revenue per order soared 102% and 88% respectively in the first six months of 2021 compared to the same period in 2020, another report finds.

Source: Southeast Asia, the home for digital transformation, Facebook and Bain & Company, 2021

The e-wallets attraction

With COVID-19 restrictions compelling small and mid-sized enterprises (SMEs) to turn to digital platforms to improve sales, the shift online is irreversible. Studies indicate a majority of B2C SMEs believe online retail will contribute over 50% of sales, pointing to the rising influence of e-tailing in fostering digital payments in Southeast Asia.

Amid the growth of digital payments, one payment method has emerged as the clear winner: e-wallets. Offered by super-apps and social commerce platforms, e-wallets do away with the need for a bank account, a particularly appealing notion to consumers in a region that is home to 290 million people without access to a bank.

Source: Riding the Pandemic Wave & Beyond, iKala, 2021

Growing consumer demand has in turn prompted more merchants to accept e-wallet payments, cementing its role as the payment of choice across the region. As e-wallet adoption among consumers and merchants alike accelerates, Southeast Asia is forecast to be the fastest-growing region in the world for e-wallets through 2025, expanding its user base by more than 300%.

The blockchain effect

With businesses racing to serve the growing demand for digital payments, more and more companies are developing new solutions to support them.

For instance, in Indonesia fintech BukuWarung is developing a payments infrastructure for the micro, small and medium enterprises (MSMEs) market. Meanwhile, in the Philippines, B2B platform GrowSari – backed by Temasek Holdings, Tencent and the International Finance Corporation – is developing financial products for sari-sari (neighbourhood) stores. SEA unicorn Nium, on the other hand, is expanding its cross-border B2B payments focus to powering “frictionless commerce” regardless of where a payment is made or received.

And as the growth of SEA’s B2B payments market picks up speed, blockchain technology has emerged as a potential game-changer. Already, the region’s corporations are testing blockchain’s capacity to enable cheaper, faster and more secure financial transactions for enterprises.

Singapore-headquartered DBS Bank has become the first bank in the region to join the global Hedera Governing Council, which oversees the Hedera network, a public distributed ledger for decentralised finance. At the same time, blockchain firms are exploring solutions to enable instant settlement of wholesale banking payments and partnering cross-border payments businesses to expand their reach. The Asean Blockchain Consortium (ABC) was also launched in 2021 to promote collaboration among blockchain organisations in Southeast Asia and Australia.

Concurrently, corporations and governments in the region remain especially mindful of the cybersecurity threats confronting digital payments. Businesses across the payments value chain are boosting user security features and introducing enhanced payment authentication solutions to merchants. Regulators in markets like Singapore, meanwhile, have announced several initiatives to make digital payments safer.

What’s clear is that an ideal combination of factors – including changing demographics and customer preferences, rapid technological advancements, private enterprise and a proactive regulatory environment – are poised to come together to build a solid foundation for Southeast Asia’s burgeoning digital payments ecosystem.

World-class communications strategy and execution

Contact us to get started