N/N was built on business from banks and other members of the traditional finance community. Our client base has broadened as we have evolved, and we’ve helped a growing range of financial innovators establish and develop their narratives – while continuing to advise clients with a much longer heritage adapt to the new world. This has given us a great vantage point to survey the battlefield as the sides have squared off in recent months.

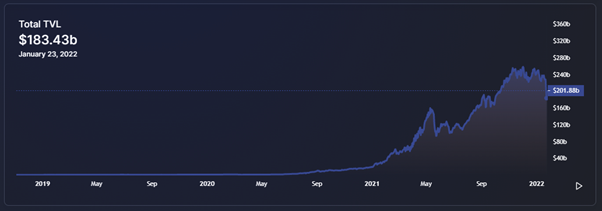

That’s an inapt metaphor, though: while it might seem that banks, brokers and old-money asset managers are under assault from an army of neophytes, on closer inspection it is less like a pitched battle and more like an ogre being bothered by a bee. By some estimates the share of crypto’s value in the global financial system, around US$2.6trn, is only around 1%, most of which is in bitcoin. Nearly all of these assets are unbacked: total value locked in decentralised finance (“DeFi”) only reached a little over US$200bn last year (see chart), before a recent selloff.

Source: DeFiLlama

Still, as Muhammad Ali knew, bees can sting. Even if they can’t just “decentralise” themselves in toto, banks, brokers and asset managers know they also can’t ignore increasing demands for smoother and more accessible financial services experiences. Though broader fintech competition for parts of the TradFi universe has been around for many years, Covid has accelerated the extent to which banks and other financial services providers have had to raise their games, particularly when it comes to customer experience. The rise of DeFi has intensified the pressure.

Dodge and weave

TradFi has responded, particularly in quotidian matters like retail transfers and domestic payments – for which the use of cash has declined steadily as wallets, QR codes and contactless cards have taken off. In Hong Kong (home of N/N HQ), in the past couple of years a cash-addicted population has become accustomed to e-money and digital wallets, with banks even rolling out virtual red packets for distribution at Chinese New Year (though the demand for pristine new banknotes has far from abated). Here, as elsewhere, banks have also done much to enable collaboration through relaxing their grip on customer data – in some cases voluntarily, in others at the behest of regulators.

The digitisation of financial services, meanwhile, has steadily increased the accessibility of finance. This, of course, is a major raison d’être of DeFi – something reiterated by Sam Bankman-Fried, CEO of crypto exchange FTX (and perhaps the richest person under 30 ever) at the recent Asian Financial Forum. Disintermediating finance and giving people better access to financial tools, he said, would have a profound impact on the financial ecosystem for the better.

Disintermediating finance and giving people better access to financial tools would have a profound impact on the financial ecosystem for the better.

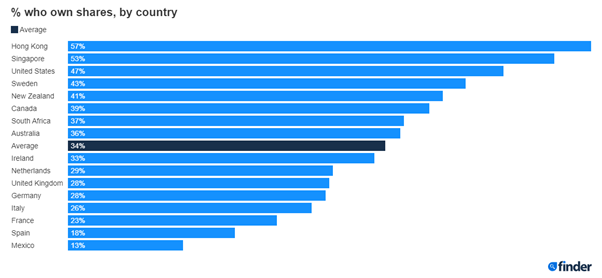

It’s an argument few would dispute. But it’s also indisputable that TradFi will have to be part of the solution. Again, the old guard is making some progress. Even in finance-saturated Hong Kong (which leads the world in the depth of its stock-owning population – see chart) new platforms have helped more people get involved. Also speaking at the AFF Angel Ng, Hong Kong and Macau CEO for Citi, revealed that 80% of customers using the bank’s digital forex trading service had never traded forex with them before. So it’s not just a matter of converting existing clients – it’s about serving a whole new cohort of people for whom many financial services had been a closed book.

Source: Finder

And it’s plain that many of these won’t want to plunge into DeFi yet. As someone who’s struggled with the maddening complexity of buying crypto – it’s not called total value locked without good reason – I find it hard to see how DeFi, in its current state, will be a genuinely democratising force in finance. That’s without factoring in issues like massive volatility, network instability, potential runs on underfunded stablecoins, and increasingly strict KYC/AML regulations that seem destined to stymie a lot of attempts to broaden its usage. I’m willing to concede I’m behind the curve, but a lot of reasonably informed people like me will have to be convinced it’s possible before DeFi comes anywhere near TradFi in its usage and appeal. (And don’t get me started on NFTs…)

Seconds out…

And yet, the scope for disruption remains considerable, partly because there is so much that remains infuriating and inefficient about financial services. Most of the trillions of AUM I mentioned above remains managed in a distinctly old-school fashion. This is partly a matter of demographics, of course: despite crypto billionaires like “SBF”, vast sums of wealth are still controlled by the older generations of wealthy families – but they won’t be around forever.

For most B2B transactions, too, TradFi remains expensive, bureaucratic and slow. I speak from experience as N/N’s de facto CFO: for the practice of moving money around, particularly overseas, “traditional” seems an insufficiently pejorative description. The scope for further disintermediation here is phenomenal.

Moreover, a lot of the fintech solutions that TradFi has rolled out remain segmented and isolated – a far cry from the integration that decentralised solutions promise. As an AFF TradFi panel noted, banks urgently must take a leaf out of the books of Asia’s super-apps (WeChat, Alipay, Grab and the like) that allow customers to do a whole range of things from a central hub. Their incredible growth has demonstrated the appeal and viability of integrating finance into broader ecosystems, as a seamless final stage of just about any transaction.

So, to return to the combat metaphor, you could call the last round even on points. Crypto may be reeling from multiple jabs thrown by the market’s recent risk-off sentiment, but the fight is still delicately poised, even considering the relative sizes of the combatants. Though a knockout seems unlikely, TradFi can’t pretend that the punches DeFi landed did no damage – or that they aren’t likely to get harder.

World-class communications strategy and execution

Contact us to get started