As Southeast Asia presses on with initiatives to help micro-enterprises and individuals build livelihoods in a digital economy that’s on track to reach US$1 trillion by 2030, the accompanying risks that have surfaced for these individuals and businesses have become too big to ignore. But those risks are also creating their own opportunities.

Changing risk profiles

The burgeoning gig economy, for instance, is seeing more individuals forego the typical safety nets – such as employer-sponsored life and health insurance, worker compensation, professional indemnity, paid medical leave – that offer a measure of protection to salaried employees. As risks are transferred from employers to individuals, policymakers are recognising the need to ensure gig workers get adequate coverage.

Recently, Singapore became the first ASEAN country to mandate platform companies provide workplace injury coverage to their food-delivery and ride-hailing partners. The move is timely as a study on delivery riders in Singapore revealed almost 60% worry about not having enough savings to tide them through if they or their dependents meet with an accident. These concerns are not misplaced considering that 38% of those who worked more than 51 hours per week have encountered more than one accident.

Meanwhile, mom-and-pop shops turned e-tailers find themselves coping with the risks that come from conducting business on online platforms as exposure to more logistics challenges, data privacy and cyber security issues become an inevitable part of their business operations. Increasing regulations for data privacy and cybersecurity across ASEAN will only bring more compliance costs.

As microentrepreneurs contend with these challenges, their potential customers – set to number 402 million by 2027 – face similar threats. The ease of researching and buying things online, including insurance, brings inconveniences and risks with it, from late or erroneous deliveries to potential data compromises. Throughout Southeast Asia, there is growing awareness of, and willingness to purchase insurance to safeguard against such incidents, according to research from reinsurer Swiss Re.

As the digital economy creates new hazards, insurers are also turning to digitalisation and capitalising on the user aggregation capability of platforms to reach more people.

Growing partnerships between insurers, insurtechs, platform businesses and other online channels are creating digital ecosystems that enable more efficient product distribution, greater customer awareness and tailored solutions. And these ecosystems are paving the way for innovative, flexible and low-cost ‘microinsurance’ products that effectively serve new risk profiles and help bridge digital protection gaps.

Digital ecosystems aid insurance innovation

Microinsurance, traditionally used as a means to protect low-income individuals by offering affordable coverage tailored to specific needs, is expected to experience strong growth in the coming years, as tech-enabled ecosystems speed up innovation and adoption.

In the Philippines, for example, a merchant platform-insurtech partnership is providing micro, small and medium enterprises (MSMEs) better access to insurance protection for their business. Meanwhile in Malaysia, a food delivery platform and insurtech firm have joined hands to speed up the claims process for delivery partners.

Other ambitious insurtechs are rapidly spreading their wings across Southeast Asia as they build partnerships with businesses across industries and insurers to develop and distribute tailored microinsurance products such as transit insurance, which protects shoppers and merchants from losses incurred on goods damaged or lost during transit.

Still others are offering insurance-as-a-service solutions to digital consumers in the region, or even bringing ’lifestyle-based’ microinsurance – such as micro-investment-linked plans to which people can contribute tiny amounts as they go about their daily routines – outside of the region. Yet another growth area aided by digital ecosystems is embedded insurance, where coverage is offered in the process of selling another product or service.

Revenues from Asia Pacific, the biggest embedded insurance market in the world, are set to nearly triple by 2029 from US$24 billion in 2022.

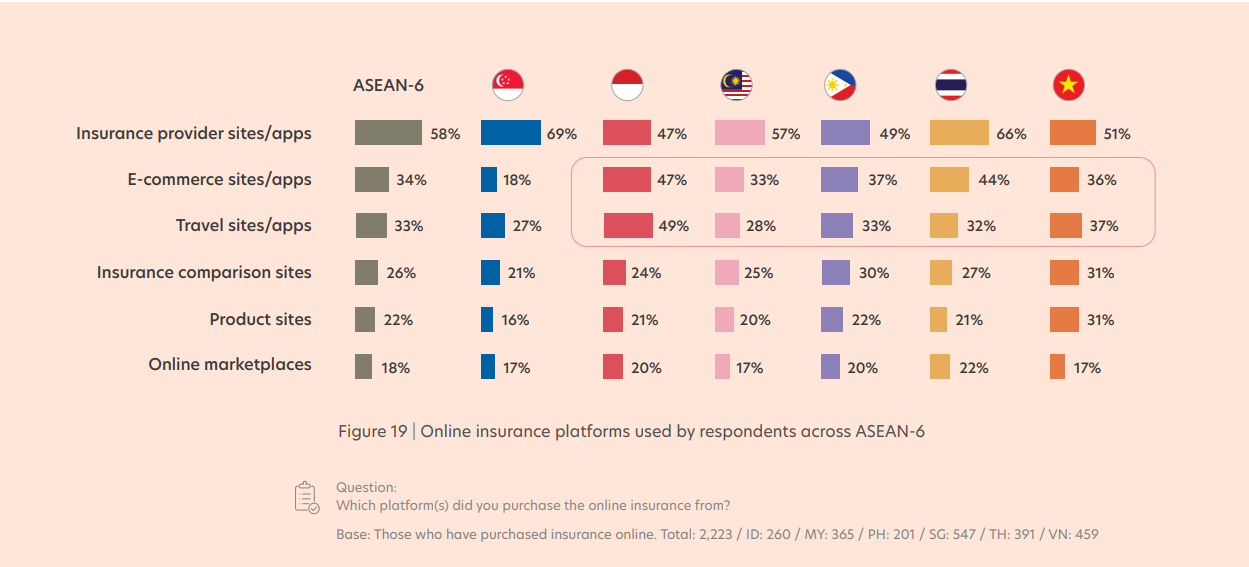

Results from a global consumer survey indicate strong interest towards bank-embedded insurance in Singapore, Thailand and Indonesia, while another study shows e-commerce and travel platforms are the most popular avenues for purchasing embedded insurance, right behind insurance provider platforms.

Source: Page 30, FinTech in ASEAN 2022: Finance, reimagined, UOB, PwC and SFA

Key to the allure of embedded insurance is the ease of purchase, along with the relevance of products. As insurtechs and traditional insurers innovate to offer protection for everything from consumer devices to mental health, purchasing insurance will also become more seamless, and more ubiquitous.

Parametric insurance, which offers pre-determined payouts based on pre-defined triggers and often provides coverage for risks outside the reach of traditional insurance, is another area primed for growth. Already there are parametric insurance products that protect SMEs from cyber risks. And more novel solutions are on the horizon globally, with one payments leader designing a Business Continuity Indicator based on payments data that will enable the development of parametric-based business interruption solutions for SMEs.

Businesses, especially small and micro-businesses, need to be mindful of technology’s double-edged blade as they grow with the aid of technology, as do consumers interacting with digital platforms. But it’s already clear digital ecosystems will also enable better access to protection, and that continued investments into insurtechs in Southeast Asia can support both the insurance industry’s growth and the region’s communities.

World-class communications strategy and execution

Contact us to get started