One major cause of the ESG backlash recently explored by my colleague Heda Bayron is greenwashing, or falsely inflating the environmental benefits of a product or practice. Unfortunately, a lot of evidence points to this not only being on the rise, but evolving into new variants, such as blue-washing (hiding the negative social impact of an entity’s actions), pink-washing (superficial promotion of LGBTQ+ causes), and purpose-washing (misrepresenting an entity as being solely driven by a social objective).

This trend has serious implications on various levels. For one, it hinders the world’s ability to address a potentially existential problem by making sceptics out of consumers and investors who vote with their feet, starving companies of the funds they need to become carbon neutral. As scepticism grows, it’s creating another issue, one very specific to B2B marketers: greenhushing, with companies increasingly disincentivised to publicise impact efforts for fear of being called out. Yet a solution may be at hand – in the form of tokenisation, which involves creating a unique digital code - or token - to represent a physical asset or a sensitive piece of data, which is stored as a blockchain.

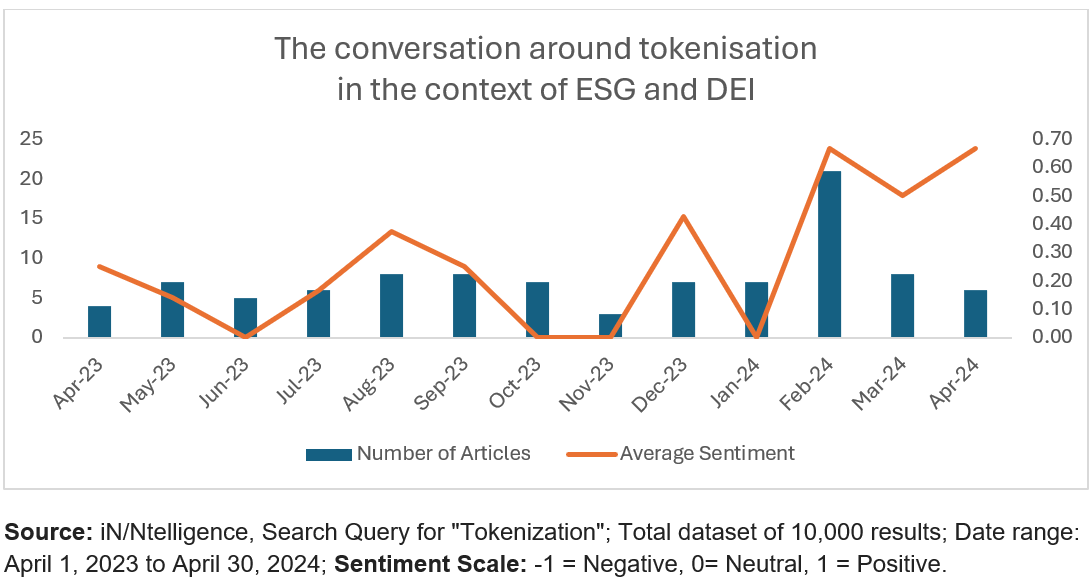

Data from N/N’s AI-driven iN/Ntelligence platform shows tokenisation is increasingly viewed as a viable means of tackling greenwashing and other challenges related to the transition effort and could help companies promote their ESG and DEI efforts with confidence. But how?

Transparency and traceability

One example is carbon offsets or credits. These work by allowing organisations that help reduce greenhouse gases (GHGs) through actions like reforestation or building renewable energy sources to sell these credits to other entities, who can use them to offset their own emissions. The funds raised help finance efforts to scrub, sequester and reduce GHGs from the atmosphere.

Tokenising these tradable instruments ensures transparency and authenticity, enabling stakeholders and third parties to monitor the veracity of such transactions in real-time. Traded on the blockchain, all past transactions involving these credits can also be readily scrutinised, allowing auditors to sign off on their legitimacy and quality. With a growing number of organisations considering this option, the total addressable market for ESG use cases of tokenisation is estimated to be between US$800 billion to US$1.6 trillion.

Plugging the transition finance gap

While greenwashing is a real problem, the other major challenge is raising the funds needed to support the green transition. Tokenisation can help on this front too. Estimates vary on exactly how much capital the world needs to make the transition to a net zero emissions future but on one point there is consensus: it involves a lot of money. Asia, which accounts for half of all carbon emissions worldwide, alone will need US$1.5 trillion in investments to reduce emissions by a third by 2030.

Blockchain is seen as a powerful tool for expanding the green finance market and funnelling crucial funds to the transition effort and markets and policymakers are turning to the technology to draw investors keen to mitigate the risk of greenwashing. Hong Kong recently became the first government in the world to issue a tokenised green bond - worth HK$800 million (US$102 million) - to fund a range of green projects, reaching an expanded investor base globally through platforms aiding cross-border transactions with the digital issuance.

Size doesn’t matter…cost does

One of the ways tokenisation is expected to help scale up green financing is by ensuring capital flows not only to mega, high-profile projects, but also to small initiatives that collectively can make a difference. Greater transparency and granularity of data enabled by tokenisation means lower risks for private investors, allowing them to cast a wider net and available financing to be distributed over a larger area and offering much-needed liquidity to smaller players.

Tokenising the green bonds that underpin sustainable infrastructure creates efficiencies throughout the ecosystem, reduces the number of intermediaries involved and brings down issuance costs, which can help offset the ’greenium‘ that investors typically pay for such assets.

Metrics as our messiah

They say numbers don’t lie. While this may ring hollow to anyone with even a rudimentary knowledge of corporate finance, hard data does paint a clearer picture, and helps businesses make sound decisions. As our colleagues in marketing will appreciate, the return on investment of a campaign can make or break its future. So too with ESG and DEI initiatives. Stakeholders need to know how existing efforts are doing and measure their impact in order to stay committed and keep the funds flowing.

Tokenisation, by its immutable nature, enables real-time, meticulous, tamper-proof and transparent record-keeping across processes, which in turn enhances reporting and governance standards. It has the potential to aid decision-making, discourage ‘washing’ and ‘hushing’ (green or otherwise), instil trust and confidence regarding an organisation’s intent and its operations, and create a virtuous cycle that could help destigmatise ESG and set the green transition journey back on track.

As iN/Ntelligence concluded after analysing thousands of articles over the past year discussing the topic of using tokenisation to aid ESG and DEI efforts:

“From this data, it's clear that the conversation around tokenisation in the context of ESG and DEI often revolves around how assets…are being transformed through blockchain technology. The emphasis on "real world assets" and "financial assets" also suggests a broader application of tokenisation to tangible and financial domains, potentially aligning with ESG principles by providing transparency and efficiency.”

World-class communications strategy and execution

Contact us to get started